Continuing our blog series where tech specialist talks about API, I want to present to you an article, written by Mehdi Medjaoui, the founder of Webshell. This post outlines major principles of B2B sharing economy powered by APIs.

There is a new dawn breaking. The sun is coming up over the marketplace and it is shining down on the whole new economy powered by APIs: the B2B Sharing Economy. Behind this in the background, shadows loom over a more traditional industrial setting: a crumbling world of siloed companies and monolithic slow-moving enterprises.

Here’s How It Happened

Large enterprises have taken decades — centuries? — to organize themselves into efficient production and business units with well-applied management theories, internally silo-ed departments, and huge IT infrastructures.

These enterprises were built on a set of economic principles that explain why and how existing companies grow and live. But now these economic principles have turned against the status quo, these same principles are now the foundation beneath the creation of new, more agile, entrepreneur-driven businesses that are competing on an equal footing with the dinosaurs of old business.

The Theory of the Firm: in a Nutshell

The set of economic principles that is disrupting and redefining the industrial marketplace is the theory of the firm. At its simplest, this theory compares two kinds of economic relationship: internal and external transaction costs.

The theory of the firm helps us understand how a business decides between doing something inside its company or finding someone in the market to do it for them. This is a decision that has had fundamental consequences for the whole of our economic societies.

Internal Transaction Costs are the costs associated with carrying out an economic function inside the company, with its internal employees and internal processes. They are the costs that start accumulating when a company says “We will do it internally”.

External Transaction Costs are the costs associated with this same economic function but in-the-market. They are the costs a company makes when it says “Let’s find someone in the market who can do it at a lower global cost of ownership (better/cheaper/faster) than we can.” They are the costs that come from saying: “Let’s outsource it.”

If the internal transaction costs end up being higher than the external transaction costs, the company starts trying to counteract this by reducing its size, and outsourcing its workload to any cheaper available external market actors.

In past centuries, a company’s actual transaction costs (both internal and external) have been influenced by a range of factors.

Internal transaction costs are influenced by the management theories, industry processes, technology, company creation processes chosen by a business, and by a business’ trust in the market rules.

External transaction costs are influenced by a range of players and actors such as governments, labor market organizations, legal obligations, the efficiency of transport and supply chain management and, most recently, by environmental considerations.

For example, it is often very difficult or costly for businesses to engage in production when they have to negotiate deals with new suppliers each time or hire and fire their workers depending on demand/supply conditions. It is also costly for suppliers to have this negotiation every time, or for employees to constantly change employment, and to be looking for better alternatives each day.

So instead, businesses enter into long-term contracts with their suppliers and employees to minimize the costs and maximize the value of property rights.

In the past ten years of technological progress, the skills needed in business IT environments have diversified and specialized at a rapid pace.

In the past ten years of technological progress, the skills needed in business IT environments have diversified and specialized at a rapid pace.

So in an economic market like France, where there are internal transaction cost pressures from heavy labor code laws, it has become more efficient to arrange IT consulting as an external transaction cost. This is why France has, compared to the size of its market, one of the most active IT consulting industries, with big companies like Cap Gemini, Accenture, Atos, Sopra and thousand of smaller ones.

A combination of the need for skills outreach and the labor policy environment, has meant that companies prefer outsourcing for specific IT skills than spending internally, where costs and time to acquire these skills internally are greater.

Similar decisions are made constantly, wherever legal and regulatory governing policies are in effect, regulations can change how a company calculates its internal and external transaction costs.

For readers who need more advanced economic argument : Why are some transactions performed within the firm rather than outside the firm?” The answer to this by the Nobel Prize economist Ronald Coase is that the “market has broken down”. However, what is interesting here is not just his answer but how he approached this question. When Coarse tried to answer this question, he broke down transactions cost into two distinct types, internal and external transaction cost. Over time, this distinction has perhaps decreased in the US where the competition is more active than other countries, but in discussing the API economy, the framework is very still relevant because we still have “broken market” and APIs is clearly having an impact on transaction cost. So using the internal and external framework I would like to show you how APIs will transform the future.

So In Summary

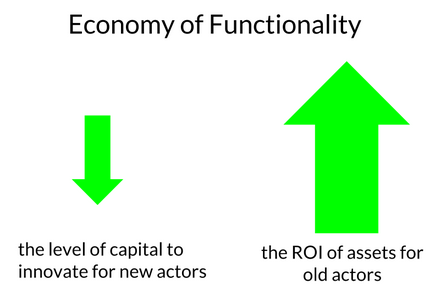

- When internal transaction costs decrease, companies grow in size and activity.

- When external transaction costs are lowered, companies diminish in size and new companies are created.

Now, APIs are coming into the market, with the promise of having substantially lower external transactional costs. This is creating a disruption effect on the stability of existing companies and their traditional approaches to balancing internal and external transaction costs.

Now, APIs are coming into the market, with the promise of having substantially lower external transactional costs. This is creating a disruption effect on the stability of existing companies and their traditional approaches to balancing internal and external transaction costs.

How APIs are the Game Changer

Open Web APIs reduce external transactions costs because:

API companies can focus on one skill and can rapidly build an API-as-a-product that is better and cheaper than internally created software. (You can see this with Salesforce, Paypal, Twilio, Stripe, and Mailchimp.)

API business models offer a low barrier to entry or a pay-as-you-go model that enables transforming fixed expenses (independent of the income) into variables expenses (that can evolve with a company’s income). API business models often follow the Software-as-a-Service model, but at a lower price point, as third parties will need to customize the API integration into their existing systems, whereas in the SaaS model, the service is consumed directly.

Distributed via the web, market outreach becomes ubiquitous, allowing international competition via a self-service model. By maximizing market entry globally, the market price tends towards its minimum. Thus, external transaction costs are lowered, whereas classical software approaches have a costly annual license fee and competition is limited to regions covered by (third party) sales teams.

Integration to third party assets is now a negligible cost, compared to the pre-APIs era. In previous decades (the pre-web API era), IT integration between companies needed:

- multiple sales meetings across weeks, maybe months, for the seller to really understand the need of the customer and for the customer to understand all the offer of the seller

- intensive (high cost) consulting with enterprise architects for deep software paradigm understanding and for integration

- annual licenses and costly new versions

- legal pattern writing and negotiations around licenses and the customization of individual contracts.

All these things were making external transaction costs higher, but now thanks to web APIs, integration involves:

- possibly no sales meetings (or perhaps just one at the end of the acquisition funnel, when the integration has already begun and is advanced), then everything is online.

- easy integration, as the customer already knows their needs and can create a solution that solves their problem with REST/JSON APIs that are easy to consume and customize to their needs.

- simpler and public terms of services with a broader field of execution, even if a customizable one is still used for more sophisticated, high-value partnerships.

As a result, APIs are diminishing external transaction costs, enabling companies to reorient their focus on their core skills. Those that focus on their core business and unique value in the market are growing by outsourcing to API companies.

As the market is reshaped by the rapid drip in external transaction costs, savvy entrepreneurs are identifying how they can be an optimized external transaction cost actor. They are configuring state of the art technology, data, skills, a favorable legal environment, their business model, and/or private assets in a way that they can lower the global cost of ownership of a particular economic function. This lets these entrepreneurs acquire customers by taking on some of the workloads of the larger enterprises.

The Entrepreneur-as-a-Service future

So here’s where we are headed. The API economy is a huge opportunity for entrepreneurs. You can create API-based businesses that offer products and services to address enterprise economic functions that have a global internal cost that is too high for organizational reasons, and that an external API can dramatically lower.

This will foster the emergence of many API companies and API-as-a-product startups, just like we have seen with the success of Salesforce for sales process management.

Already, entrepreneurs are capitalizing on new growth opportunities by offering APIs as products in the niche, highly-specialized industry sectors. For example, Avalara is a startup that is focused on calculating Federal taxes on products sold and delivered. For large company manufacturers and suppliers, undertaking these calculations has a high internal cost. Avalara has replaced those internal transaction costs by offering an easily integrated API, which they provide as an external transaction economic function. Companies keen to be flexible in the new sharing economy are now outsourcing this cost, resulting in Avalara’s rapid startup growth.

Economic sunlight is now falling somewhere between the giant enterprises and their traditional decision-making approaches, and the nimble startups with their laser-like focus on API-specific products and services in the new sharing economy.

Larger enterprises are like Atlas, holding up the world, but unable to respond quickly to the new market environment as they are weighed down by the traditional enterprise they have built on their shoulders. To maintain success, these established, larger players are learning to quickly apply the theory of the firm to outsource more of their non-core, high internal transaction cost economic functions.

Entrepreneurial-minded startups are springing up in the fertile ground of the new sharing economy, each with a focus on providing a specific service or product that can take advantage of the outsourcing potential arising in the market.

And now it’s your turn: what API company are you thinking of creating today?

Hope, this article has answered all your dizzying questions. Don’t hesitate to comment and share your expert’s opinion on the topic.

P.S. The source post you can find here